Accommodation:

Rental costs will depend on where in the UK you are going to be living and working, and the closer to central London you are, the costlier it will be.

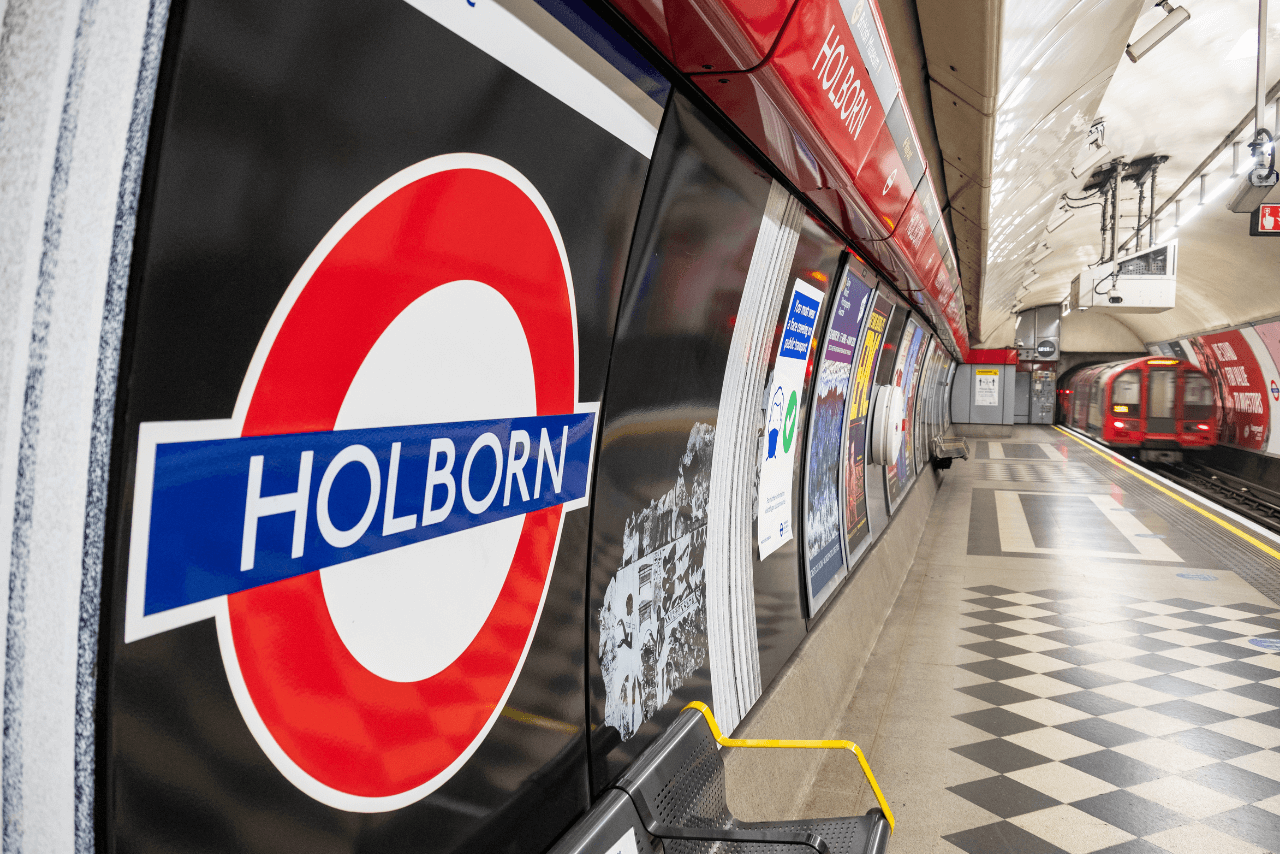

You should consider living slightly further out and using the Underground. Living a few Tube stops out of Zone 1 will be more affordable. You can expect to pay £500-£800 for a room in London, which includes bills.

Many people house share as this is a great way to lower your rental costs, and to make new friends.

If city life isn’t for you, there are some amazing places to explore, live and work across the UK.

Living on the outskirts of London (try Essex, Kent or Hertfordshire) will reduce your accommodation costs, and there are great transport links which will mean you can easily dip into the Capital in your free time.

Moving further north to the Midlands, Lincolnshire, Yorkshire or Manchester and you can seriously reduce your outgoings. You could certainly afford to live alone in certain parts of the UK – and it makes sense to search for a room or property with bills included.

You may be surprised to hear that many people actually save money while they are living, working and enjoying the UK!

Tax:

In countries such as Canada and Australia you will pay between 10-40% tax depending on your income. In the UK you will pay a basic rate of 20% – it’s a great potential saving!

National Insurance:

Everyone who lives and works in the UK contributes towards the National Health Service. Approximately 13% of your pay will go towards allowing you to visit the doctor or dentist.

GP surgeries are usually the first contact if you have a health problem. When you arrive, you should register with your local NHS GP surgery.